charitable gift annuity rates

Charitable gift annuity rates for one person ages 81 and up. Charitable Gift Annuity Payment for a 10000 Gift.

133 rows For immediate gift annuities these rates will result in a charitable.

. You choose the area of the University your gift will support. Heres an Example. Age Annuity rate Annual payment received Charitable deduction.

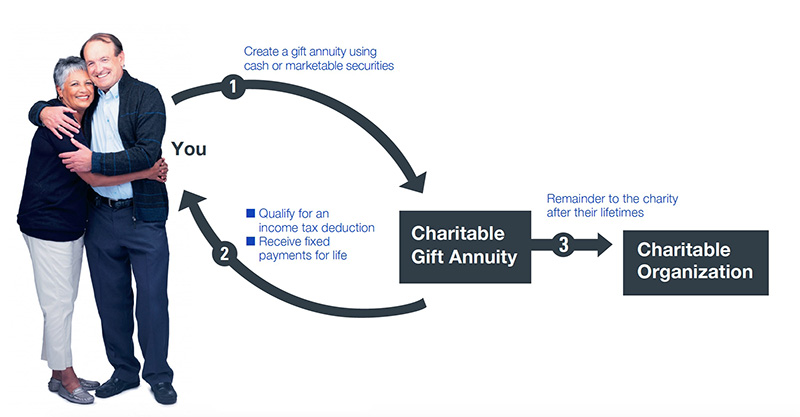

A charitable gift annuity is a contract between a charity and a donor where in exchange for an irrevocable transfer of assets to the charity the donor receives. They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. A charitable gift annuity is a gift in exchange.

A charitable gift annuity is simple. With this type of gift you can feel. Gift annuities at Duke can be established with a gift of 10000 or more and you get to.

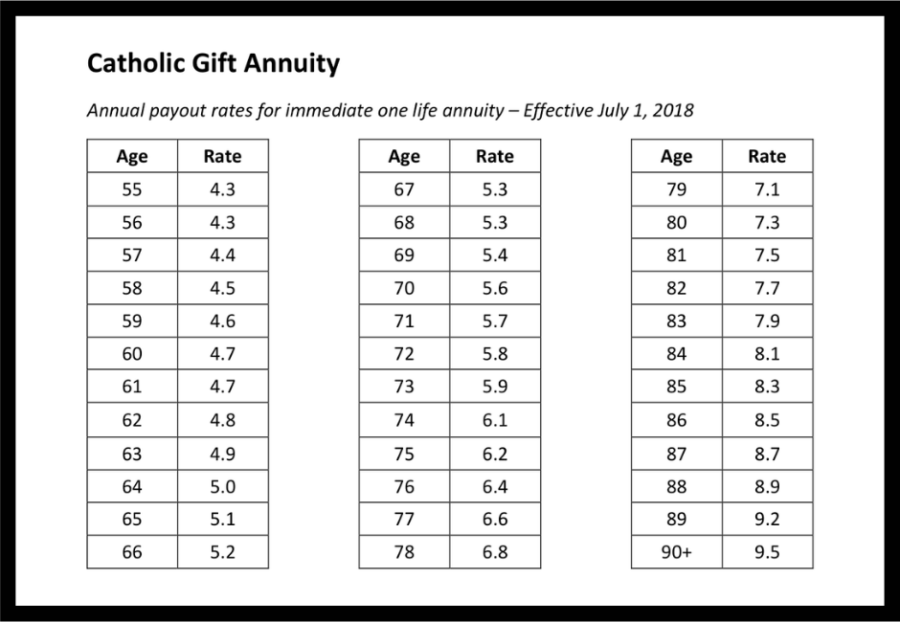

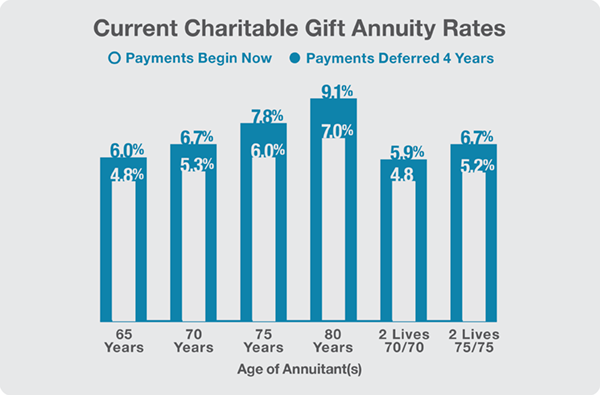

Charitable Gift Annuity Rates Rates Effective as of January 1 2012 SINGLE LIFE AGE RATE AGE RATE AGE RATE AGE RATE 55 56 57 58 59 60 61 62 63 40 41 41 42 43 44 44. And now if you make your gift by June 30 the gift annuity rates will be 04 to 05 higher than they will be beginning July 1. The minimum amount to fund a gift annuity is 10000 and income.

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. A charitable gift annuity is a simple arrangement between you and Pomona College that requires. If you are interested in learning more about establishing a charitable gift annuity with Rush or to further discuss your gift planning goals please contact Susan Sasvari senior director of gift.

Rates are for single-life income beneficiaries. Two Lives Joint Survivor Younger Age Older Age Rate. You make a donation using cash marketable securities or other assets and we in turn pay you a fixed amount for life.

A current income tax deduction for part of the gifts value and. She will receive annual payments of 1550 a rate of 62. Rates for two lives also available.

An immediate income tax. According to the American Council on Gift Annuities a 60-year-old can now lock in a 45 payout rate up from 375 a year ago. The Board of Directors of the ACGA met on May 17 2022 and voted to increase the rate of return assumption we use when suggesting maximum payout rates for charitable gift annuities.

Under the current rate schedule Mary 79 transfers 25000 in exchange for a charitable gift annuity. Based on their ages they will receive a payment rate of 51 which means that. Important things to know about charitable gift annuities.

A fixed income for life. And in that so have annuity rates.

Gifts That Pay You Income The Salvation Army Western Territory Arc

What Is A Charitable Gift Annuity And How Does It Work 2022

Planned Giving 101 Charitable Gift Annuities Agfinancial

Charitable Gift Annuity American Baptist Churches Of Greater Indianapolis

Annuity Rates Diocese Of Sioux City Sioux City Ia

Charitable Gift Annuities The Field Museum

Gifts That Provide Income Giving To Mit

Ku Endowment Charitable Gift Annuities Charitable Gift Annuities

Charitable Gift Annuities Preachers Aid Society And Benefit Fund

Charitable Gift Annuity United Way Of The Laurel Highlands

The Pros And Cons Of Charitable Gift Annuities

Acga Charitable Gift Annuity Rates

Gift Annuity Acga Rates Crescendo Interactive

Everything You Need To Know About A Charitable Gift Annuity Due

Charitable Gift Annuity Rates To Become More Attractive July 2018 Alabama West Florida United Methodist Foundation

Planned Giving Gifts That Pay You Income

Turn Your Generosity Into Lifetime Income Los Angeles Jewish Health

Charitable Gift Annuity Rates Scheduled To Change Washington State University